2025 News Releases

December 29, 2025

Dieppe, N.B. – December 29, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) announces that it has filed a listed issuer financing document for a non-brokered listed issuer financing (the "LIFE Offering"). Following consultations with the Autorité des Marchés Financier (the "AMF"), the Company has determined that the original LIFE financing announced on October 23, 2025 along with the amended LIFE financing announced on December 8, 2025 have expired under the provisions of Part 5A of National Instrument 45-106 and, as such, the offering documents filed in relation thereto are no longer valid. Under the LIFE Offering, the Company proposes to sell up to 7,000,000 units ("NFT Units") at a price of $0.15 per NFT Unit for proceeds of $1,050,000 and up to 4,200,000 flow-through units ("FT Units") at a price of $0.18 per FT Unit for proceeds of up to $756,000 for total gross proceeds of $1,806,000. Each NFT Unit will be comprised of one (1) common share (a "Common Share") and one (1) Common Share purchase warrant of Canadian Gold (each a "Warrant"). Each FT Unit will be comprised of one (1) flow-though common share (an "FT Share") and one half (1/2) of a Warrant. The Warrant terms are as follows: commencing on the 62nd day after issuance, each whole Warrant will entitle the holder to acquire one Common Share of the Company at a price of C$0.22 per Common Share for a period of 36 months from the date of issuance, provided, however, that should the closing price at which the Common Shares trade on the TSX Venture Exchange (the "TSXV") (or any such other stock exchange in Canada as the Common Shares may trade at the applicable time) exceed $0.45 for ten (10) consecutive trading days at any time, the Company may accelerate the Warrant term (the "Reduced Warrant Term") such that the Warrants shall expire on the date which is 30 business days following the date a press release is issued by the Company announcing the Reduced Warrant Term. The restrictive exercise period on the Warrants has been imposed to ensure that the LIFE Offering complies with certain dilution restrictions under the listed issuer financing exemption. Upon closing of the LIFE Offering, the Common Share component of the NFT and FT Units will be free trading in Canada. Any Common Shares issued upon exercise of an NFT or FT Warrant after the restrictive period expires will be free trading in Canada. Subject to certain adjustments for president's list purchasers, qualified finders are entitled, on the Closing Date, to a cash commission equal to 8% of the gross proceeds of the LIFE Offering and will receive finder's warrants (each, a "Finder's Warrant") equal to 8% of the number of the NFT Units and the FT Units issued pursuant to the LIFE Offering. Each Finder's Warrant entitles the holder thereof to purchase one Common Share at a price of (a) $0.15 per Common Share for NFT Units sold; and (b) at a price of $0.18 for FT Units sold for a period of 36 months from the date of issuance, provided, however, that should the closing price at which the Common Shares trade on the TSXV (or any such other stock exchange in Canada as the Common Shares may trade at the applicable time) exceed $0.45 for ten (10) consecutive trading days at any time following the date that is four months and one day after the date of issuance, the Company may accelerate the Finder's Warrant term (the "Reduced Warrant Term") such that the Finder's Warrants shall expire on the date which is 30 business days following the date a press release is issued by the Company announcing the Reduced Warrant Term. The Finder's Warrants are subject to a hold period of four months and one day after the date of issuance. The NFT Units and the FT Units will be offered for sale in each of the provinces of Canada, except Quebec, pursuant to the listed issuer financing exemption (the "Listed Issuer Financing Exemption") under Part 5A of NI 45-106 Prospectus Exemptions and Coordinated Blanket Order 45-935 Exemptions from Certain Conditions of the Listed Issuer Financing Exemption. The Company has filed a Form 45-106F19 (the "Offering Document") with the securities commissions or similar regulatory authorities in each of the provinces of Canada, other than Quebec. The Offering Document related to the LIFE Offering can be accessed under the Company's profile at www.sedarplus.ca and on the Company's website at https://www.cdngold.com/ . Prospective investors should read this Offering Document before making an investment decision. Non-Brokered Private Placement Due to exceptionally strong investor interest in flow-through securities, the Company will also be conducting a concurrent, non-brokered private placement (the "FT Placement Offering") of up to 7,200,000 flow-through units (the "FT Placement Units") at a price of $0.18 per FT Placement Unit for gross proceeds of up to $1,296,000. The FT Placement Units will be sold to accredited and other qualified investors in Canada under appropriate exemptions in National Instrument 45-106 Prospectus Exemptions. Each FT Placement Unit will be comprised of one (1) flow through common share and one half (1/2) of a common share purchase warrant, each whole warrant entitling the holder to acquire one non-flow through common share at a price of $0.22 per Common Share for a period of 36 months from the date of issuance provided, however, that should the closing price at which the Common Shares trade on the TSX Venture Exchange (the "TSXV") (or any such other stock exchange in Canada as the Common Shares may trade at the applicable time) exceed $0.45 for ten (10) consecutive trading days at any time, the Company may accelerate the Warrant term (the "Reduced Warrant Term") such that the Warrants shall expire on the date which is 30 business days following the date a press release is issued by the Company announcing the Reduced Warrant Term. All securities issued pursuant to FT Placement Offering will be subject to a hold period of four months plus a day from the date of issuance. Subject to certain adjustments for president's list purchasers, qualified finder's will be entitled to a cash commission equal to 8% of the gross proceeds of the FT Placement Offering and will receive finder's warrants (each, a "Finder's Warrant") equal to 8% of the number of FT Placement Units sold. Each Finder's Warrant entitles the holder thereof to purchase one Common Share at a price of $0.18 for a period of 36 months from the date of issuance, provided, however, that should the closing price at which the Common Shares trade on the TSXV (or any such other stock exchange in Canada as the Common Shares may trade at the applicable time) exceed $0.45 for ten (10) consecutive trading days at any time following the date that is four months and one day after the date of issuance, the Company may accelerate the Finder's Warrant term (the "Reduced Warrant Term") such that the Finder's Warrants shall expire on the date which is 30 business days following the date a press release is issued by the Company announcing the Reduced Warrant Term. The Finder's Warrants are subject to a hold period of four months and one day after the date of issuance. Research Capital Corporation will act as exclusive finder and sole booker runner to assist with both the LIFE Offering and the FT Placement Offering. The FT Placement Offering and a tranche of FT Units under the LIFE Offering are expected to close on or before December 31, 2025 with a final tranche of NFT Units under the LIFE Offering expected to close on or before January 31, 2026. Both the FT Placement Offering and the LIFE Offering are subject to regulatory approvals and customary closing conditions including listing of the Common Shares on the TSX Venture Exchange. The gross proceeds from the sale of the NFT Units, the FT Units and the FT Placement Units will be used for exploration and drilling on the Lac Arsenault project, the Robidoux project and VG Boulder project as well as working capital. The gross proceeds received by the Company from the sale of the FT Units and the FT Placement Units will be used to incur eligible "Canadian exploration expenses" (as defined under the Income Tax Act) that qualify as "flow-through mining expenditures" (the " Qualifying Expenditures ") related to the Company's Quebec mining properties on or before December 31, 2026, and to renounce all the Qualifying Expenditures in favour of the purchasers of the FT Units and FT Placement Units effective December 31, 2025. In the event the Company is unable to renounce Qualifying Expenditures effective on or prior to December 31, 2025 for each FT Units and FT Placement Units purchased in an aggregate amount not less than the gross proceeds raised from the issue of the FT Units and the FT Placement Units, the Company will indemnify each FT Unit and FT Placement Unit purchaser for the additional taxes payable by such purchaser as a result of the Company's failure to renounce the Qualifying Expenditures as agreed. The securities in the LIFE Offering and the FT Placement Offering have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any U.S. state securities laws, and may not be offered or sold in the United States without registration under the U.S. Securities Act and all applicable state securities laws or compliance with the requirements of an applicable exemption therefrom. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor may there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. Amendments to Corporate Presentation The Company also wishes to announce that, in conjunction with the LIFE Offering and the FT Placement Offering, it has made certain amendments to its corporate presentation on its portfolio of properties. The amended presentation may be found on the Company's website at https://www.cdngold.com/ . These amendments include the deletion of certain projections which are more appropriately presented under a geological report prepared in accordance with National Instrument 43-101 and certain deficient property images.

December 8, 2025

Dieppe, N.B. – December 8, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) announces that, further to its press releases dated October 23 and November 14, 2025, it will be conducting an amended non-brokered listed issuer financing exemption ("LIFE") private placement financing (the "Offering") through the sale of up to 12,666,667 units ("NFT Units") at a price of $0.15 per NFT Unit and up to 5,555,556 flow-through units ("FT Units") at a price of $0.18 per FT Unit for total gross proceeds of $2.9 million. The Company has engaged Research Capital Corporation (the "Finder") as exclusive finder and sole booker runner to assist with the Offering. The Offering may close in tranches with a final tranche closing (if required) expected on or before December 31, 2025 (the "Final Closing Date") and will be subject to regulatory approvals and customary closing conditions including listing of the Common Shares on the TSX Venture Exchange. Each NFT Unit will be comprised of one (1) common share (a "Common Share") and one (1) Common Share purchase warrant of Canadian Gold (each a "Warrant"). Each FT Unit will be comprised of one (1) flow-though common share (an "FT Share") and one half (1/2) of a Warrant. The Warrant terms are as follows: commencing on the 62nd day after issuance, each whole Warrant will entitle the holder to acquire one Common Share of the Company at a price of C$0.22 per Common Share for a period of 36 months from the date of issuance, provided, however, that should the closing price at which the Common Shares trade on the Toronto Venture Exchange (the "TSXV") (or any such other stock exchange in Canada as the Common Shares may trade at the applicable time) exceed $0.45 for ten (10) consecutive trading days at any time, the Company may accelerate the Warrant term (the "Reduced Warrant Term") such that the Warrants shall expire on the date which is 30 business days following the date a press release is issued by the Company announcing the Reduced Warrant Term. The restrictive exercise period on the Warrants has been imposed to ensure that the Offering complies with certain dilution restrictions under the LIFE exemption. Upon closing of the Offering, the Common Share component of the NFT and FT Units will be free trading in Canada. Any Common Shares issued upon exercise of an NFT or FT Warrant after the restrictive period expires will be free trading in Canada. The gross proceeds from the sale of NFT Units will be used for exploration and drilling on the Lac Arsenault project, the Robidoux project and VG Boulder project as well as working capital. The gross proceeds received by the Company from the sale of the FT Units will be used to incur eligible "Canadian exploration expenses" (as defined under the Income Tax Act) that qualify as "flow-through mining expenditures" (the " Qualifying Expenditures ") related to the Company's Quebec mining properties on or before December 31, 2026, and to renounce all the Qualifying Expenditures in favour of the purchasers of the FT Units effective December 31, 2025. In the event the Company is unable to renounce Qualifying Expenditures effective on or prior to December 31, 2025 for each FT Unit purchased in an aggregate amount not less than the gross proceeds raised from the issue of the FT Units, the Company will indemnify each FT Unit purchaser for the additional taxes payable by such purchaser as a result of the Company's failure to renounce the Qualifying Expenditures as agreed. The NFT Units and the FT Units will be offered for sale in each of the provinces of Canada, except Quebec, pursuant to the listed issuer financing exemption (the "Listed Issuer Financing Exemption") under Part 5A of NI 45-106 Prospectus Exemptions and Coordinated Blanket Order 45-935 Exemptions from Certain Conditions of the Listed Issuer Financing Exemption. The Company has filed an amended and restated Form 45-106F19 (the "Offering Document") with the securities commissions or similar regulatory authorities in each of the provinces of Canada, other than Quebec. The Offering Document related to the Offering that can be accessed under the Company's profile at www.sedarplus.ca and on the Company's website at https://www.cdngold.com/ . Prospective investors should read this Offering Document before making an investment decision. Subject to certain adjustments for president's list purchasers, the Finder is entitled, on the Closing Date, to a cash commission equal to 8% of the gross proceeds of the Offering and will receive finder's warrants (each, a "Finder's Warrant") equal to 8% of the number of the NFT Units and the FT Units issued pursuant to the Offering. Each Finder's Warrant entitled the holder thereof to purchase one Common Share at a price of $0.15 per Common Share for a period of 36 months from the date of issuance, provided, however, that should the closing price at which the Common Shares trade on the TSXV (or any such other stock exchange in Canada as the Common Shares may trade at the applicable time) exceed $0.45 for ten (10) consecutive trading days at any time following the date that is four months and one day after the date of issuance, the Company may accelerate the Finder's Warrant term (the "Reduced Warrant Term") such that the Finder's Warrants shall expire on the date which is 30 business days following the date a press release is issued by the Company announcing the Reduced Warrant Term. The Finder's Warrants are subject to a hold period of four months and one day after the date of issuance. The securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any U.S. state securities laws, and may not be offered or sold in the United States without registration under the U.S. Securities Act and all applicable state securities laws or compliance with the requirements of an applicable exemption therefrom. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor may there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

November 25, 2025

Dieppe, N.B. – Novem ber 25, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) is pleased to report that its maiden diamond drill program at the Lac Arsenault Project is now underway. Drill equipment has arrived on site, and the Company has completed the first drill collar. A total of 12 drill pads have been constructed to support initial drilling at the high-grade Baker Vein, forming the first phase of the Company's planned program. Canadian Gold is currently operating under a permit authorizing 36 drill holes totaling approximately 3,000 metres. As previously announced on November 14, 2025 ( Link to press release ), the Company has submitted an amended permit application to the Ministère des Ressources naturelles et des Forêts (MRNF), which is currently being reviewed. If approved, the amended permit would allow the drill program to expand to up to 60 drill holes, including approximately 15 holes designed to test new high-priority vein and stockwork-style targets identified through the recent Induced Polarization ("IP") survey. Management Commentary "Today marks an important milestone for Canadian Gold as we begin our maiden diamond drill program at Lac Arsenault," said Ron Goguen, President & CEO of Canadian Gold Resources. "The team has worked extremely hard to advance the Project to this stage, and we are pleased to have drilling underway on the Baker Vein. The recent geophysical work has significantly expanded our understanding of the structural corridor, and we believe the upcoming drill program, particularly the new targets identified through IP, has the potential to meaningfully advance the Project. We look forward to providing updates as the assay results become available, likely in the first quarter of 2026."

November 14, 2025

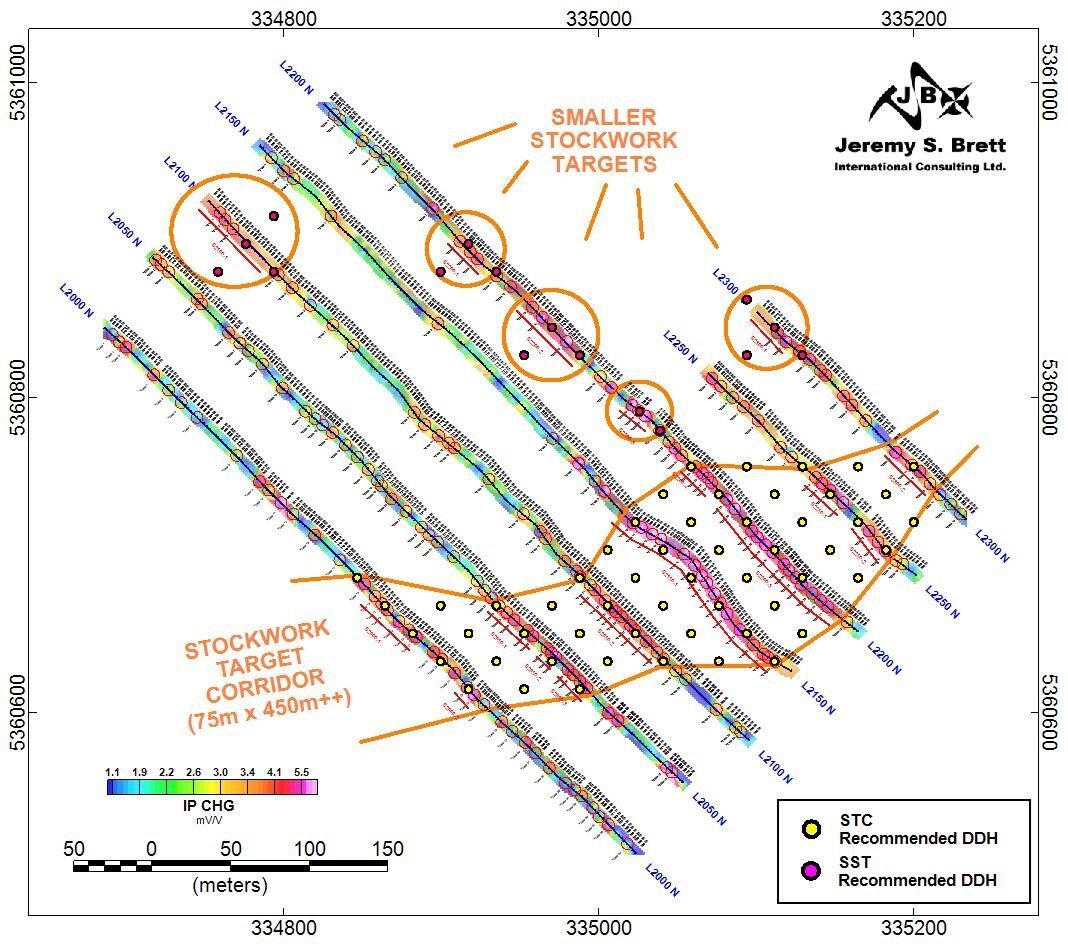

Dieppe, N.B. – November 4, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) provides an operational update regarding its maiden diamond drill program and the planned 5,000-tonne bulk sampling program at the 100%-owned Lac Arsenault Project in Québec's Gaspé Peninsula, as well as recent changes to the Company's LIFE offering. Company Plans to Significantly Increase Maiden Lac Arsenault Diamond Drill Program Canadian Gold has submitted amended permit applications seeking approval to expand its maiden drill program to roughly twice the originally planned scope of 36 holes totaling 3,000 metres. This decision follows ongoing geophysical interpretation that has identified numerous high priority vein and stockwork type drill targets. The Company recently completed a tightly spaced Induced Polarization ("IP") survey across the Baker–Mersereau structural corridor. Preliminary geophysical interpretation work carried out by Jeremy S. Brett International Consulting Ltd. has identified multiple IP signatures along Line 2200N that closely resemble the response associated with the known high-grade Baker vein (please see Image 1, below). Although the Mersereau vein has not yet been fully interpreted on the current working map, its position and continuity are clearly expressed in the IP data, further reinforcing the technical rationale for expanding the drill program. In addition, possible stockwork zones have been identified up to 100m wide. These new geophysical targets, combined with a second set of drill collar locations submitted under the amended permit application, support the potential for a substantially larger first-phase drill campaign. The targets are situated within what the Company and its consultants refer to as the Stockwork Target Corridor, a near-surface (0–30 metres vertical depth) zone characterized by strong structural preparation and distinctive geophysical response. Given the strength and coherence of these new geophysical targets, the Company is evaluating a plan to materially increase the number of drill holes beyond the previously permitted minimum, with the objective of fully testing these newly defined priority areas. Management Commentary "We are very encouraged by the results of our recent Induced Polarization ("IP") Survey at Lac Arsenault," said Ron Goguen, President & CEO of Canadian Gold Resources. "The tightly spaced IP work across the Baker–Mersereau structural corridor has outlined multiple new high-priority vein and stockwork targets, some of which mirror the response of the high-grade Baker vein. The data also clearly define the continuity of the Mersereau vein. Based on these findings, we've submitted amended permits to roughly double the size of our maiden drill program to properly test these new geophysical targets." "The delay in receiving the ATI permits pushed our operating window into winter conditions", said Mr. Goguen. "Extracting and transporting material at this time of year would not be safe, or cost-effective. Out of caution we have elected to move the bulk sample into the spring of 2026. This results in only a minimal shift to the expected timing of results and any related free cash flow and we remain fully prepared to proceed as soon as conditions allow." Bulk Sample Program Deferred to Spring 2026 Due to Permitting Delays and Seasonal Access Constraints The Company is pleased to confirm that it has now obtained all permits required to execute the bulk sampling program, including the Authorization for Work in the Environment (ATI), as well as all approvals received during the recently completed First Nations consultation process. These permitting achievements represent a significant milestone for the Company and fully clear the regulatory path for bulk sample extraction. Although Canadian Gold is fully permitted and operationally ready, the start of bulk sample extraction has been rescheduled to spring 2026. The primary reason for this deferral is the later-than-expected receipt of the final ATI permit, which occurred after the Company's anticipated timeline. By the time approval was received, winter conditions in the Lac Arsenault area had already set in, with significant snowfall and ground freeze-up limiting safe and efficient field operations. Attempting to extract and transport mineralized material during winter would materially increase costs, reduce operational efficiency, and introduce unnecessary safety risks. Management has therefore determined that initiating the program in early spring 2026 is the most prudent and responsible course of action. While the timing of the physical extraction has shifted, the Company expects the financial implications of this revised schedule to be minimal. Under the previous plan, extraction was to begin in autumn 2025, with processing anticipated by mid-Q1 2026. With extraction now scheduled for spring 2026, the Company expects to receive results and related cash flow from the bulk sampling program in Q3 2026, representing only a modest adjustment to the timing of potential proceeds. IP Survey Lines, Gridded Chargeability & Planned Drill Holes

November 4, 2025

Dieppe, N.B. – November 4, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) is pleased to announce that the maiden diamond drill program at its 100%-owned Lac Arsenault Property, located in Québec's Gaspé region, is scheduled to commence on November 10, 2025. The program will comprise a minimum of 3,000 metres of diamond drilling in at least 36 holes, targeting multiple high-priority zones along the Grand Pabos Fault system. The campaign is expected to span approximately four weeks, with initial assay results anticipated in Q1 2026. Management Commentary "Initiating our maiden drill program at Lac Arsenault is a significant step forward for Canadian Gold," said Ronald Goguen, President and CEO. "This program is designed to confirm the strength, continuity, and expansion potential of gold mineralization within this promising structural corridor—an essential step toward unlocking near-term value and advancing the project toward production readiness." The drill program is designed to achieve several key objectives: Modernize and validate historical data Canadian Gold intends to establish a comprehensive, NI 43-101-compliant database integrating assay results and QA/QC protocols. The program will twin select historical holes at the Baker Vien and Mersereau Vein and complete step-out drilling to verify grades, continuity, and data integrity. These results will support the advancement of a potential NI 43-101-compliant mineral resource estimate. Refine geological and structural understanding Drilling will further define the geometry, grade distribution, and continuity of mineralized zones by improving the interpretation of structural and lithological controls on gold mineralization. This work will test both lateral and vertical extensions of known zones, evaluate alteration patterns, and enhance the geological model that underpins future targeting and resource expansion. Expand mineralization along strike and at depth Using data from recent induced polarization (IP) and geophysical surveys, the program will target extensions of the gold-bearing structures at the Baker Vien and Mersereau Vein. The focus will be on step-outs and deeper holes aimed at confirming the strike and vertical continuity of mineralization and identifying new zones of potential discovery. About the Lac Arsenault Project The Lac Arsenault Property, located in Québec's Gaspé region, lies along the Grand Pabos Fault within the Gaspé–Newfoundland tectonic belt. This structure shares geological characteristics with prolific gold-bearing systems such as the Cadillac–Larder Lake Fault Zone in Abitibi and the Cape Ray–Valentine Lake Shear Zone in Newfoundland. The property hosts several high-grade, epithermal-style vein systems, including the Baker, Mersereau, and Dunning veins, with historical exploration outlining significant gold-silver-base metal mineralization that provides a strong platform for the Company's current work. Covering more than 3,600 hectares, Lac Arsenault is strategically located near tidewater at New Richmond, Québec, offering excellent road, power, and rail infrastructure within one of Canada's most established mining jurisdictions. Historical Resource Estimate Disclosure (NI 43-101 2.4) Stevenson, L. (1975): 40,000 tonnes grading 15.43 g/t Au and 197 g/t Ag (Esso Minerals Canada). Côté, R. (1996): 199,580 tonnes grading 9.59 g/t Au (~61,536 contained oz Au). These historical estimates predate NI 43-101 and were based on sampling, trenching, and drilling using manual polygonal methods. A Qualified Person has not completed sufficient work to classify the estimates as current mineral resources or reserves. The Company is not treating them as current and further verification is required. These historical estimates pre-date the adoption of current CIM Definition Standards (2014) and therefore cannot be directly compared to modern resource categories (i.e., "Inferred," "Indicated," or "Measured"). The terminology and estimation methodologies used at the time are not compliant with current CIM categories, and no classification equivalence is implied. The Company considers these historical estimates to be relevant, as they demonstrate the presence of significant gold and silver mineralization at shallow depths within the Baker and Mersereau vein systems, which remain priority targets for verification and expansion. However, their reliability is uncertain because the underlying data, methods, and QA/QC procedures are not adequately documented to current standards. The Company is not treating the estimate as current. To the Company's knowledge, there are no more recent mineral resource estimates available for the Lac Arsenault Property that would supersede these historical figures. To bring these into compliance, Canadian Gold plans to: Conduct systematic drilling to confirm grades and geometry; Complete verification sampling and density determinations; Build a validated geological model with modern QA/QC protocols; Commission an independent NI 43-101 compliant resource estimate. Qualified Person Statement: The scientific and technical information in this news release has been reviewed and approved by Mark Smethurst, P.Geo., Director of Canadian Gold and a Qualified Person under NI 43-101.

October 27, 2025

Dieppe, N.B. – October 27, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) is pleased to announce that it has received the required permits to commence drilling at its 100%-owned Lac Arsenault Gold Project, located in the Gaspé Peninsula, Québec. The maiden drill program, expected to commence on or around November 17, 2025, will consist of a minimum of 36 drill holes totaling approximately 3,000 metres. The objectives of the program include: Establishing a modern, NI 43-101-compliant database of assay and QA/QC results to validate and advance the historical resource model at the Baker Vien and Mersereau Vein. Historical drilling outlined near-surface gold mineralization but pre-dates current reporting standards. The new program will twin select holes and complete step-out drilling to confirm grades, continuity, and data quality in support of a potential NI 43-101-compliant mineral resource estimate. Enhancing geological understanding of grade distribution and mineralized continuity by refining the structural and lithological controls on gold mineralization at the Baker Vien and Mersereau Vein. Drilling will test lateral and vertical extensions of mineralized zones, assess alteration patterns, and strengthen the geological model to support future resource estimation and targeting. Testing the strike and vertical extent of known gold-bearing structures using results from the recent induced polarization (IP) survey and geophysics work to refine drill targeting. The data will guide step-out and deeper drilling aimed at extending mineralization and identifying additional zones along strike and at depth. Management Commentary "Our team is excited to advance the Lac Arsenault property through its first modern drill campaign," said Ronald Goguen, President and CEO of Canadian Gold Resources Ltd. "This program represents an important milestone in confirming historical mineralization and defining the broader exploration potential of this high-grade, unexplored gold system." Canadian Gold anticipates the potential to expand the program with additional metres and drill holes as new targets are identified. These targets are being refined using data from an ongoing induced polarization (IP) survey conducted in conjunction with existing aeromagnetic (Mag) data, designed to highlight high-priority anomalies across the project area. About the Lac Arsenault Project The Lac Arsenault Property, located in Québec's Gaspé region, lies along the Grand Pabos Fault within the Gaspé-Newfoundland tectonic belt. This structure shares geological characteristics with prolific gold-bearing systems such as the Cadillac-Larder Lake Fault Zone in Abitibi and the Cape Ray-Valentine Lake Shear Zone in Newfoundland. The property hosts several high-grade, epithermal-style vein systems, including the Baker, Mersereau, and Dunning veins, with historical exploration outlining significant gold-silver-base metal mineralization that provides a strong platform for the Company's current work. Covering more than 3,600 hectares, Lac Arsenault is strategically located near tidewater at New Richmond, Québec, offering excellent road, power, and rail infrastructure within one of Canada's most established mining jurisdictions. Historical Resource Estimate Disclosure (NI 43-101 2.4) Stevenson, L. (1975): 40,000 tonnes grading 15.43 g/t Au and 197 g/t Ag (Esso Minerals Canada). Côté, R. (1996): 199,580 tonnes grading 9.59 g/t Au (~61,536 contained oz Au). These historical estimates predate NI 43-101 and were based on sampling, trenching, and drilling using manual polygonal methods. A Qualified Person has not completed sufficient work to classify the estimates as current mineral resources or reserves. The Company is not treating them as current and further verification is required. These historical estimates pre-date the adoption of current CIM Definition Standards (2014) and therefore cannot be directly compared to modern resource categories (i.e., "Inferred," "Indicated," or "Measured"). The terminology and estimation methodologies used at the time are not compliant with current CIM categories, and no classification equivalence is implied. The Company considers these historical estimates to be relevant, as they demonstrate the presence of significant gold and silver mineralization at shallow depths within the Baker and Mersereau vein systems, which remain priority targets for verification and expansion. However, their reliability is uncertain because the underlying data, methods, and QA/QC procedures are not adequately documented to current standards. The Company is not treating the estimate as current. To the Company's knowledge, there are no more recent mineral resource estimates available for the Lac Arsenault Property that would supersede these historical figures. To bring these into compliance, Canadian Gold plans to: Conduct systematic drilling to confirm grades and geometry; Complete verification sampling and density determinations; Build a validated geological model with modern QA/QC protocols; Commission an independent NI 43-101 compliant resource estimate. Qualified Person Statement: The scientific and technical information in this news release has been reviewed and approved by Mark Smethurst, P.Geo., Director of Canadian Gold and a Qualified Person under NI 43-101

October 23, 2025

Dieppe, N.B. – October 23, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) announces a non-brokered listed issuer financing exemption ("LIFE") private placement financing (the "Offering") for total gross proceeds of up to $3.0 million, with up to $2,000,000 in units ("NFT Units") and up to $1,000,000 in flow-through units ("FT Units"). The Company has engaged Research Capital Corporation (the "Finder") as exclusive finder and sole booker runner to assist with the Offering. The NFT Units are priced at $0.20 per NFT Unit. Each NFT Unit will be comprised of one (1) common share (a "Common Share") and one (1) Common Share purchase warrant of Canadian Gold (a "NFT Warrant"). Subject to the restrictive period described below, each NFT warrant is exercisable for 3 years from the Closing Date at an exercise price of $0.28 per Common Share. The FT Units are priced at $0.30 per FT Unit. Each FT Unit will be comprised of one (1) flow-though common share (a "FT Share") and one half of one (1/2) Common Share purchase warrant of Canadian Gold (the "FT Warrant"). Subject to the restrictive period described below, each whole FT warrant will be exercisable for 3 years from the Closing Date at an exercise price of $0.40 per Common Share. Upon closing of the Offering, the Common Share component of the NFT and FT Units will be free trading in Canada. As the Company completed a financing less than 12 months ago (see the Company's new release dated January 2, 2025), all FT and NFT Warrants in this Offering will be restricted from being exercised for a period of 61 days after closing to ensure compliance with the dilution restriction in section 5A.2(h) of the LIFE exemption in National Policy 45-106. Any Common Shares issued upon exercise of a NFT or FT Warrant after the restrictive period expires will be free trading in Canada. The net proceeds from this Offering will be used for exploration and drilling on the Lac Arsenault project, the Robidoux project and VG Boulder project as well as working capital. The NFT Units and the FT Units will be offered for sale in each of the provinces of Canada, except Quebec, pursuant to the listed issuer financing exemption (the "Listed Issuer Financing Exemption") under Part 5A of National Instrument 45-106 - Prospectus Exemption. The Company has filed a Form 45-106F19 with the securities commissions or similar regulatory authorities in each of the provinces of Canada, other than Quebec. There is an offering document related to this Offering that can be accessed under the Company's profile at www.sedarplus.ca and on the Company's website at https://www.cdngold.com/ . Prospective investors should read this offering document before making an investment decision. The Offering is expected to close on or about November 7, 2025 (the "Closing Date") and will be subject to regulatory approvals and customary closing conditions including listing of the Common Shares on the TSX Venture Exchange. Subject to certain adjustments for president's list purchasers, the Finder is entitled, on the Closing Date, to a cash commission equal to 8% of the gross proceeds of the Offering and will receive finder's warrants entitling the Finder, for a period of 3 years from the Closing Date, to acquire that number of Common Shares that is equal to 8% of the number of the NFT Units and the FT Units issued pursuant to the Offering, at an exercise price of $0.20 per Common Share. The securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any U.S. state securities laws, and may not be offered or sold in the United States without registration under the U.S. Securities Act and all applicable state securities laws or compliance with the requirements of an applicable exemption therefrom. This press release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor may there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

September 16, 2025

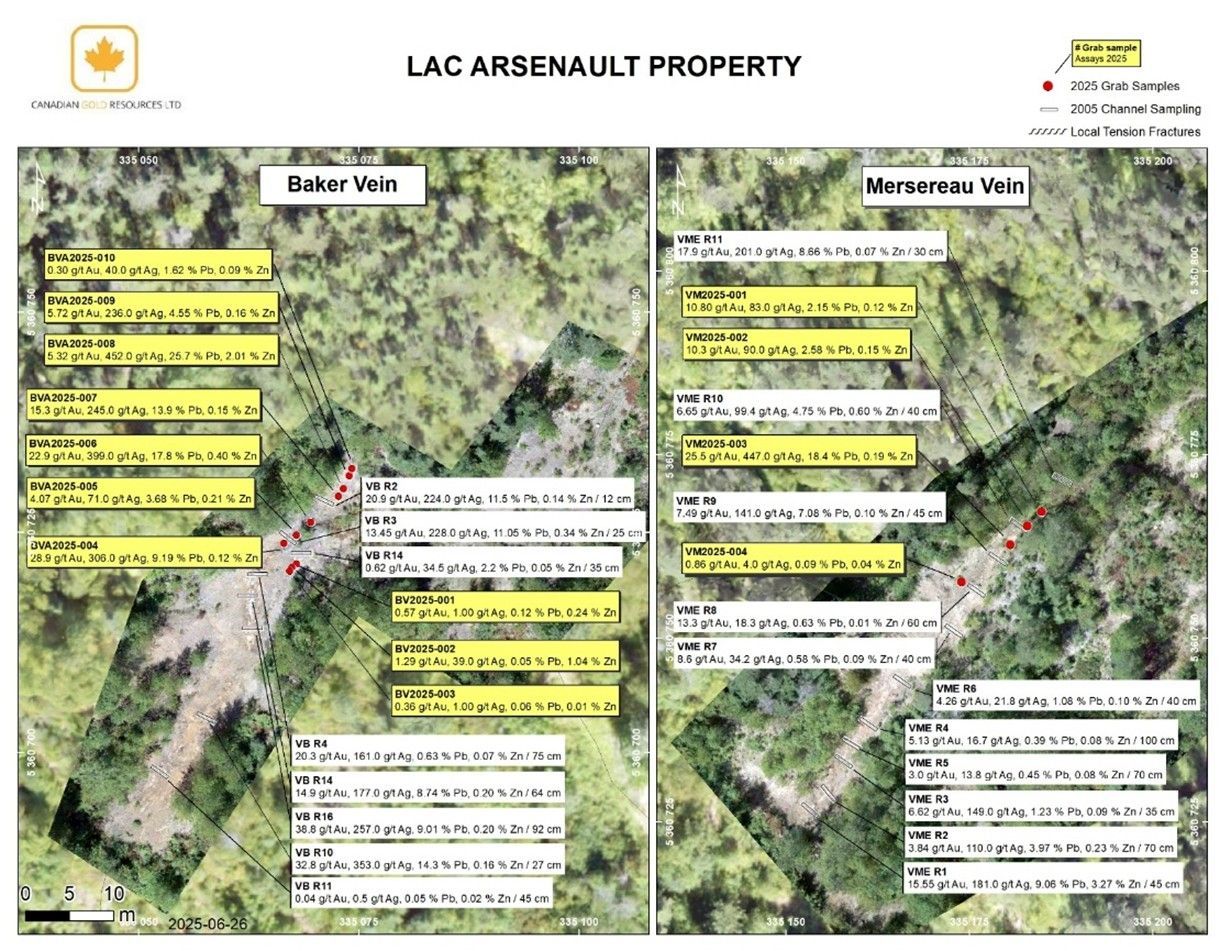

Dieppe, N.B. – September 16, 2025 – Canadian Gold Resources Ltd. (“Canadian Gold” or the “Company”), is pleased to announce that it has engaged Geophysique TMC to conduct an induced polarization ("IP") survey at its 100%-owned Lac Arsenault Property, located in the Gaspé region of Québec. The survey is intended to enhance the Company's understanding of the structures that control three key mineralized zones - the Baker Vein, the Mersereau Vein, and the Type-4 Vein - and to help identify high-priority targets for future drill programs. These three veins host the historical non-NI 43-101 compliant resource estimates previously reported for the Lac Arsenault Property (please see Historical Resource Estimate Disclosure (NI 43-101 2.4), below). The data from the IP survey will be integrated into Canadian Gold's expanding exploration dataset, which already incorporates recent surface sampling results. Mechanical trenching and sampling along the Baker and Mersereau veins returned very high grades from surface exposures, including 28.9 g/t gold and 306 g/t silver (BVA2025-004) and 22.9 g/t gold and 399 g/t silver. Complementing this, airborne magnetic survey work at Lac Arsenault has outlined major fault structures, including the Grand Pabos Fault, together with newly recognized splays and secondary structures interpreted to be important controls on the emplacement of gold-silver-lead mineralization. Together, these results are sharpening Canadian Gold's exploration focus on high-priority targets while reinforcing the broader discovery potential across the Lac Arsenault property. Management Commentary "The initiation of this IP survey represents another important step in uncovering the value of our Lac Arsenault property by refining and prioritizing targets for the upcoming maiden diamond drill program," stated Ronald Goguen, President & CEO of Canadian Gold. "By applying modern geophysical techniques, we aim to validate historical results and further sharpen our understanding of the Baker, Mersereau, and Type-4 veins." An IP survey is a geophysical technique used to measure the electrical chargeability and resistivity of subsurface materials. In exploration settings, this method can detect disseminated sulphide mineralization associated with gold and base metal systems. By mapping variations in chargeability and resistivity across the target area, the survey provides a powerful tool to refine drill targets, prioritize anomalies, and strengthen the Company's exploration model. About the Lac Arsenault Project The Lac Arsenault Property is located in Québec's Gaspé region along the Grand Pabos Fault, part of the Gaspé-Newfoundland tectonic belt. This structure shares geological characteristics with prolific gold-bearing systems such as the Cadillac-Larder Lake Fault Zone in Abitibi and the Cape Ray-Valentine Lake Shear Zone in Newfoundland. The property hosts multiple high-grade, epithermal-style vein systems, including the Baker, Mersereau, and Dunning veins. Historical exploration outlined significant gold-silver-base metal mineralization, providing a strong foundation for the Company's current work. Historical Resource Estimate Disclosure (NI 43-101 2.4) Stevenson, L. (1975): 40,000 tonnes grading 15.43 g/t Au and 197 g/t Ag (Esso Minerals Canada). Côté, R. (1996): 199,580 tonnes grading 9.59 g/t Au (~61,536 contained oz Au). These historical estimates predate NI 43-101 and were based on sampling, trenching, and drilling using manual polygonal methods. A Qualified Person has not completed sufficient work to classify the estimates as current mineral resources or reserves. The Company is not treating them as current and further verification is required. To bring these into compliance, Canadian Gold plans to: Conduct systematic drilling to confirm grades and geometry; Complete verification sampling and density determinations; Build a validated geological model with modern QA/QC protocols; Commission an independent NI 43-101 compliant resource estimate.

September 10, 2025

Dieppe, N.B. – September 10, 2025 – Canadian Gold Resources Ltd. (“Canadian Gold” or the “Company”), is pleased to provide an update on its exploration and development activities at its 100%-owned Lac Arsenault Property located in the Gaspé region of Québec. The Company is also announcing the resignation of Ken Booth from the Board of Directors. Applications Submitted for Lac Arsenault Maiden Drill Program Canadian Gold has submitted permit applications to the Ministère des Ressources naturelles et des Forêts (MRNF) for its maiden diamond drilling program on the Lac Arsenault Property. The proposed program comprises 36 drill holes totalling approximately 2,345 metres, with expected drilling to begin upon permit approval. The objective of the drill program is to take the extensive historical work completed at Lac Arsenault and advance it to modern reporting standards under National Instrument 43-101. Historical work at Lac Arsenault (1975–1996) outlined non-compliant resource estimates ranging from 40,000 tonnes at 15.43 g/t Au and 197 g/t Ag to approximately 200,000 tonnes averaging 9.59 g/t Au (~61,500 oz Au). These estimates predate NI 43-101 and cannot be relied upon as current resources, but they highlight the project’s long-recognized high-grade potential. Through the upcoming drill program, Canadian Gold intends to: Twin and verify historical drill holes and channel samples to confirm grades and geometry; Apply modern QA/QC protocols to establish reliability of the data; Generate sufficient new drilling data to support an independent mineral resource estimate prepared in accordance with NI 43-101 and CIM Definition Standards; Convert these historical estimates into a current, compliant mineral resource that can be reported to the market, forming a strong foundation for future project development and valuation. Management Commentary "The submission of our first drill permit applications marks an important milestone as we move toward validating the historic high-grade results at Lac Arsenault and establishing an NI 43-101 compliant resource base,” stated Ronald Goguen, President & CEO of Canadian Gold. “We believe Lac Arsenault represents a rare opportunity in Québec, one of the world’s most proven mining jurisdictions: a project with extensive historical work, strong high-grade potential, and excellent infrastructure. By applying modern exploration standards, we are committed to unlocking this value responsibly while engaging transparently with Québec regulators and local First Nations communities.” Update on Bulk Sampling Program On July 15, 2025, Canadian Gold announced that it had received permits from the Government of Québec to proceed with a 5,000-tonne bulk sampling program, conditional upon the completion of three shallow water monitoring wells in the vicinity of the proposed sampling area ( See July 9, 2025 press release ) and an Autorisation pour travaux à impacts (ATI) report. The Company is ready to drill these wells immediately; however, the Québec’s Ministère des Ressources naturelles et des Forêts (MRNF) has since requested that Canadian Gold temporarily pause while it seeks additional input from another First Nations community, located approximately 18 kilometres from the proposed bulk sampling site. Canadian Gold has already engaged with the Gesgapegiag First Nation community, which is domiciled within the project area, providing full details of the program and receiving no opposition during the allotted feedback period. In compliance with the ATI requirements, the Company is now re-engaging with the Mi'gmawei Mawio’mi Secretariat (MMS), the political and tribal council representing the three Mi'gmaq First Nations in the Gaspé region, to ensure transparency and comply with ATI. In parallel, Canadian Gold continues to work closely with the MRNF to finalize the process and is scheduled to meet jointly with the MMS and MRNF on September 11, 2025, regarding the ATI. At this time, the Company does not anticipate a material delay to the commencement of the bulk sampling program. Board Resignation Mr. Ken Booth has resigned as a Director of Canadian Gold, effective immediately, to focus on other professional commitments. The Board thanks Mr. Booth for his valued contributions since the Company’s inception and wishes him every success in his future endeavours. About the Lac Arsenault Project The Lac Arsenault Property is located in Québec’s Gaspé region along the Grand Pabos Fault, part of the Gaspé–Newfoundland tectonic belt. This structure shares geological characteristics with prolific gold-bearing systems such as the Cadillac–Larder Lake Fault Zone in Abitibi and the Cape Ray–Valentine Lake Shear Zone in Newfoundland. The property hosts multiple high-grade, epithermal-style vein systems, including the Baker, Mersereau, and Dunning veins. Historical exploration outlined significant gold-silver-base metal mineralization, providing a strong foundation for the Company’s current work. Historical Resource Estimate Disclosure (NI 43-101 2.4) Stevenson, L. (1975): 40,000 tonnes grading 15.43 g/t Au and 197 g/t Ag (Esso Minerals Canada). Côté, R. (1996): 199,580 tonnes grading 9.59 g/t Au (~61,536 contained oz Au). These historical estimates predate NI 43-101 and were based on sampling, trenching, and drilling using manual polygonal methods. A Qualified Person has not completed sufficient work to classify the estimates as current mineral resources or reserves. The Company is not treating them as current and further verification is required. To bring these into compliance, Canadian Gold plans to: Conduct systematic drilling to confirm grades and geometry; Complete verification sampling and density determinations; Build a validated geological model with modern QA/QC protocols; Commission an independent NI 43-101 compliant resource estimate.

July 15, 2025

Dieppe, N.B. – July 15, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) is pleased to announce that it has received all required permits from the Government of Québec to proceed with a bulk sampling program with plans to test 5,000 tonnes of mineralized materials at its 100%-owned Lac Arsenault Gold Project, located in the Gaspé region of eastern Québec. The bulk sample is intended for exploration purposes only and is not considered a production decision. As a condition of the permit, the Company is required to drill three (3) shallow water monitoring wells in the vicinity of the proposed sampling area to identify potential groundwater presence. If water tables are encountered, baseline water quality testing will be conducted both before and after the program. Canadian Gold fully supports this requirement as part of its commitment to responsible exploration and environmental stewardship. Next Steps With permits secured, Canadian Gold will now begin preparations for mobilizing personnel and equipment to site. In the coming weeks, the Company will finalize agreements with drilling, excavation, and haulage contractors, complete the required water wells, and install temporary infrastructure to support safe operations near the Baker and Mersereau veins. Once site preparation is complete, material sampling is anticipated to commence and continue for approximately three weeks. The sampled material will be transported to a third-party facility for off-site processing and analysis. Updates will be provided as results become available, including recoveries and implications for future exploration planning. Management Commentary Ron Goguen, President & CEO of Canadian Gold, commented: “ Receiving this permit is a major milestone in the advancement of our Lac Arsenault Project. This program is designed to evaluate the technical and geological characteristics of the near-surface mineralization. Historical work conducted by Imperial and Esso Minerals in the 1970s reported a historical estimate of approximately 40,000 tonnes grading 15.43 g/t gold and 197 g/t silver (Stevenson, L., 1975, Geological Report on the Lac Arsenault Property, Esso Minerals Canada). A subsequent 1996 report revised the estimate to 199,580 tonnes grading 9.59 g/t gold, or approximately 61,536 contained ounces (Côté, R., 1996, Lac Arsenault Project Resource Evaluation, Unpublished Internal Report). While these historical estimates do not comply with current CIM standards, they indicate strong historical interest in this high-grade system. Additional core drilling, systematic surface sampling, and database verification will be required to validate the data and assess whether a current resource can be defined. ” Clarification on Economic Potential While Canadian Gold is encouraged by the opportunity to generate technical and metallurgical data from the bulk sample, no economic analysis has been completed, and there are no mineral reserves at Lac Arsenault. Any references to possible revenue from sample processing are entirely speculative and do not demonstrate economic viability. There is no production decision and no feasibility study has been conducted. Should positive results occur, proceeds may be allocated toward working capital, additional exploration, or future shareholder returns, but no production decision or dividend policy has been made at this time. There is no assurance that results will support future exploration or development decisions.

July 9, 2025

Dieppe, N.B. – July 9, 2025 – Canadian Gold Resources Ltd. (TSXV: CAN) (“Canadian Gold” or the “Company”) is pleased to report exciting new surface sampling results from its 100%-owned Lac Arsenault Property , located in Québec’s underexplored Gaspé Peninsula. This latest fieldwork, conducted in early June 2025, focused on exposing and sampling the Baker and Mersereau veins—two primary structures central to the Company’s upcoming bulk sample program. High-grade assay results continue to validate Lac Arsenault’s strong potential to host a precious metals system, while also identifying new zones of mineralization in previously overlooked areas. Sampling Highlights: Sample BVA2025-004: 28.9 g/t gold, 306 g/t silver Sample BVA2025-006: 22.9 g/t gold, 399 g/t silver, 17.8% lead Sample Mersereau (unnumbered): 25.5 g/t gold, 447 g/t silver, 18.4% lead Sample BVA2025-008: 5.32 g/t gold, 452 g/t silver, 25.7% lead These grades are significant for surface sampling and support the near-surface potential for bulk-tonnage extraction.

June 12, 2025

Dieppe, N.B. – June 12, 2025 – Canadian Gold Resources Ltd. (“Canadian Gold” or the “Company”), is pleased to report the completion of key site preparation activities at its 100%-owned Lac Arsenault Gold Project, located in the Gaspé region of Quebec. As part of preparations for the upcoming bulk sample program, Company crews have conducted surface washing of outcrop exposures at both the Mersereau and Baker Veins to further delineate mineralized structures and optimize the bulk sampling plan. The Mersereau and Baker Veins, previously highlighted in the Company’s April 22 and May 16, 2025 news releases, are known to host high-grade gold and silver mineralization. The recent washing activities have successfully enhanced surface visibility, exposed fresh mineralized rock and aided in the design of targeted extraction areas for the upcoming bulk sample.

Stay Updated With Canadian Gold

Sign up for our newsletter to receive news releases and exclusive company updates.

Thank you for subscribing to Canadian Gold Resources Mailing List.

Oops, there was an error sending your message.

Please try again.