NEWS RELEASE

Amseco Exploration Announces Definitive Agreement For Proposed Reverse Takeover Transaction With Canadian Gold Resources Ltd.

MONTREAL, June 3, 2024 /CNW/ - AMSECO EXPLORATION LTD. (TSXV: AEL.H) ("Amseco"), a mineral exploration company listed on the NEX board of the TSX Venture Exchange (the "Exchange"), is pleased to announce that further to its press release dated December 19, 2023 it has entered into a share exchange agreement with Canadian Gold Resources Ltd. ("Canadian Gold") and the shareholders of Canadian Gold (the "Canadian Gold Shareholders"), dated May 31, 2024 (the "Agreement") in respect of a proposed share acquisition of Canadian Gold (the "Transaction"). It is anticipated that the Proposed Transaction will constitute a "Reverse Takeover" of Amseco in accordance with Policy 5.2 – Changes of Business and Reverse Takeovers of the Exchange and is considered an arm's length transaction. All currency references herein are in Canadian currency unless otherwise specified.

About Canadian Gold

Canadian Gold is a private company existing under the laws of Canada with gold projects in the Gaspé gold belt in the Province of Québec. Immediately prior to closing of the Transaction, Canadian Gold shall have 20,000,000 common shares (the "Canadian Gold Shares") outstanding, excluding any securities issued pursuant to the Concurrent Financing (as defined herein).

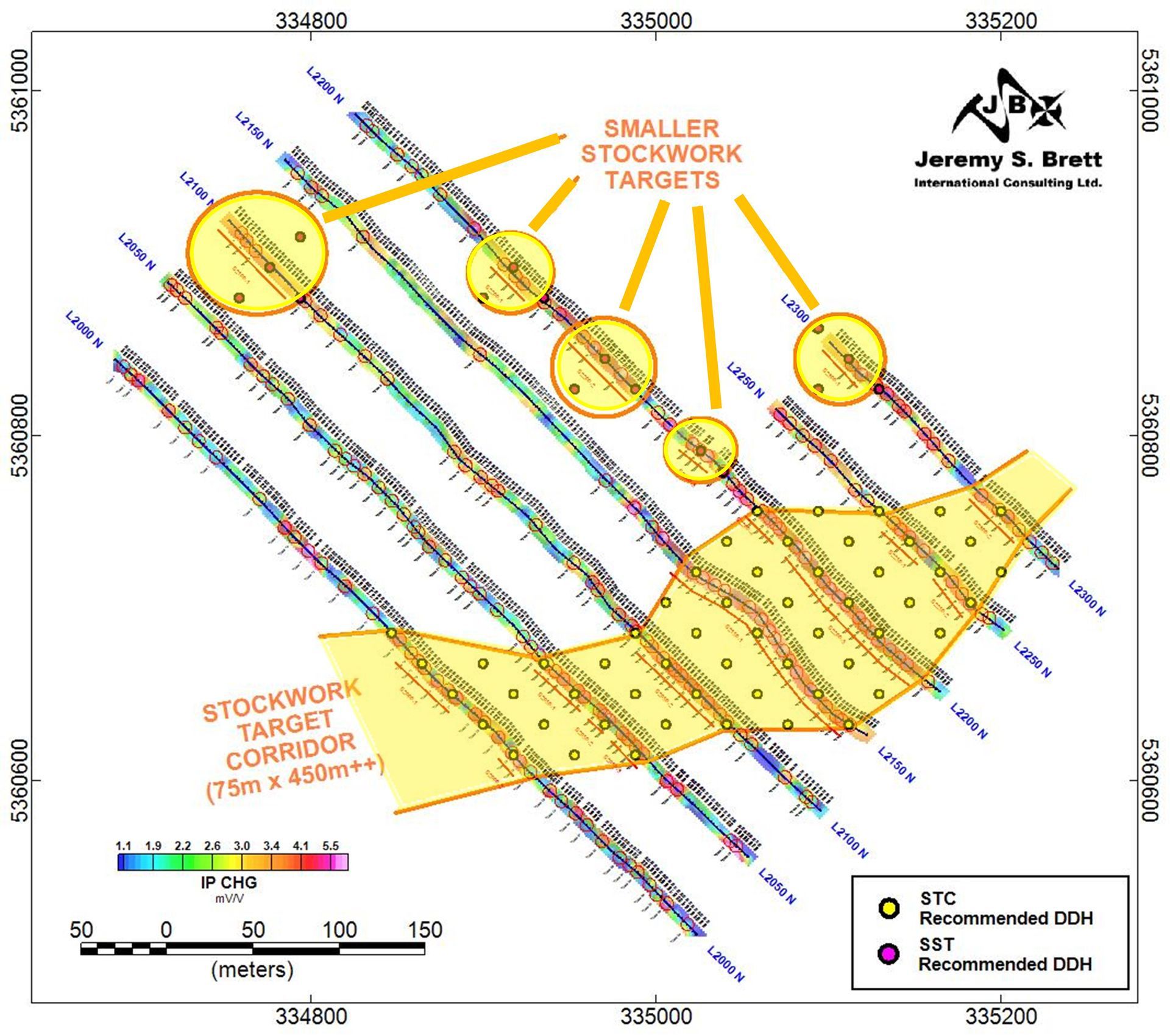

Canadian Gold's material asset consists of its 100% interest in three gold exploration projects: (i) the Lac Arsenault property; (ii) the VG Boulder Property, and (iii) the Robidoux property (collectively, the "Properties") along the Grand Pabos Fault on the Gaspe Peninsula of Quebec. Gold mineralization in the region is known to be hosted by structures related to the Grand Pabos Fault, a major regional structure that can be traced across the entire Gaspe Peninsula and into Newfoundland where major gold discoveries have been made recently. Canadian Gold holds the Robidoux property (1,940 hectares), the VG Boulder property (5,787 hectares), and the Lac Arsenault property (4,118 hectares. The Properties combine to cover 34km along the Grand Pabos Fault system, gold is associated with major structural systems such as strike-slip faults, breccia zones, and swarm structures.

Canadian Gold considers only the Lac Arsenault property to be material in accordance with National Instrument 43-101 – Standard of Disclosure for Mineral Projects ("NI 43-101"). Subject to confirmation from the Exchange, concurrent with the completion of the Transaction and the listing of common shares of the resulting entity (the "Resulting Issuer") on the Exchange, the Resulting Issuer will file a technical report in accordance with NI 43-101 for the Lac Arsenault property.

The Properties are located in the province of Québec, Gaspé Peninsula, southwest of Gaspé Municipality accessible by logging road approximately twenty-five kilometers north of the village of Paspebiac. They are situated in a sequence of Palaeozoic (Era) metasedimentary rocks, located near the eastern end of the Aroostook-Matapedia Anticlinorium a major structural unit of the Appalachians that extends from Matapedia to Percé in Quebec. Mineralization occurs within the Honorat Group rocks, is vein type, characterized by brittle deformation and occurs in competent Ordovician (Period) Honorat Group sandstones and greywackes.

Lac Arsenault

In 1946 Walter Baker, a prospector, discovered boulders containing gold, silver and the sulphides sphalerite, galena, arsenopyrite and pyrite. This property was explored by Imperial & Esso Minerals in the mid 1970's who identified 40,000 tonnes at 15.43 g/t Au, 197.00 g/t Ag, 6.6% Pb, and 3.5% Zn in three veins exposed on surface (Baker vein, Mersereau vein, and L4W vein) (this estimate is historical and has not been verified – it is not NI 43-101 compliant –additional work is required to confirm this estimate). Historic assays of up to 1.4 oz Au/ton and 25 oz Ag/ton have been recorded. Base metal ranges from traces up to 15 percent combined Pb-Zn. Best results include 32.83 g/t Au over 0.27 m at the Baker vein. Best results from the southern part of the L4W vein include 13.5 g/t Au over 0.75m. Best results at the Mersereau vein include 39.7 g/t Au on surface. In 1986 an exploration program discovered a new Au bearing zone, Marleau vein, with an assay of 0.36 oz Au/t over 5.2 feet. The Lac Arsenault property has 93 historic drill holes totaling 7269.41m.

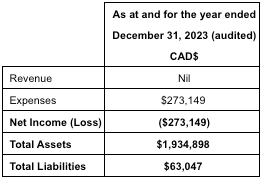

Summary of Financial Information

The following table presents selected financial information on the financial condition and results of operations of Canadian Gold. Such information is derived from the audited financial statements of Canadian Gold for the period of incorporation (January 22, 2023) to the year ended December 31, 2023. The interim financial statements of Canadian Gold for the three-month period ended March 31, 2024 are currently being generated and will be provided in a subsequent press release, once available. The information provided herein should be read in conjunction with Canadian Gold's financial statements, which will be contained in the filing statement to be filed on SEDAR+ in connection with the Transaction.

For further information regarding Canadian Gold, please contact Ron Goguen, President and CEO, at 506-866-4545 or rongoguen@cdngold.com.

Summary of the Proposed Transaction

Pursuant to the Agreement, in consideration for the acquisition of all the issued and outstanding common shares in the capital of Canadian Gold (the "Canadian Gold Shares"), the Company will issue 20,000,000 common shares in the capital of the Company (the "Amseco Shares") on a post-Consolidated (as defined herein) basis, at a deemed price of $0.25 per Amseco Share. The Transaction will result in the reverse takeover of Amseco by Canadian Gold. As of the date of the Agreement, Canadian Gold currently has 20,000,000 Canadian Gold Shares outstanding and nil securities convertible into Canadian Gold Shares.

The post-Consolidation Amseco Shares to be issued pursuant to the Transaction will be issued pursuant to exemptions from the prospectus requirements of applicable securities legislation. Certain common shares of the Resulting Issuer to be issued pursuant to the Proposed Transaction are expected to be subject to restrictions on resale or escrow under the policies of the Exchange, including the securities to be issued to "Principals" (as defined under the Corporate Finance Manual of the Exchange), which will subject to the escrow requirements of the Exchange. Upon completion of the Transaction, it is anticipated that the Resulting Issuer will be listed as a Tier 2 Mining Issuer on the Exchange, with Canadian Gold as its primary operating subsidiary.

Consolidation

Prior to the closing of the Transaction, Amseco will consolidate its outstanding Amseco Shares on the basis of one (1) post-consolidation Amseco Share for each 5 pre-consolidation Amseco Shares (the "Consolidation"), such that, prior to closing of the Transaction, Amseco will have approximately 2,922,854 Amseco Shares issued and outstanding on a non-diluted basis.

Name Change

It is anticipated that the Resulting Issuer will continue the business of Canadian Gold and is to be renamed "Canadian Gold Resources Ltd." or such other name as determined by Canadian Gold (the "Name Change"). The business of the Resulting Issuer will be primarily focussed on the exploration of the Property.

Conditions

The completion of the Transaction remains subject to a number of terms and conditions, among other standard conditions for a transaction of this nature, including, among other things: (i) Canadian Gold delivering a NI 43-101 compliant technical report for the Lac Arsenault property that is acceptable to the Exchange and Amseco; (ii) the delivery of audited, unaudited and pro forma financial statements of each party that are compliant with Exchange policies; (iii) no material adverse changes occurring in respect of either Amseco or Canadian Gold; (iv) the parties obtaining all necessary consents, orders and regulatory and shareholder approvals, including the conditional approval of the Exchange subject only to customary conditions of closing; (v) if required by the Exchange, delivery of a sponsor report and an independent valuation satisfactory to the Exchange; (vi) the Consolidation, Name Change and any other corporate changes requested by Canadian Gold, acting reasonably, shall have been implemented; and (vii) completion of the Concurrent Financing (as defined herein); (viii) completion of satisfactory due diligence by each party. There can be no assurance that all of the necessary regulatory and shareholder approvals will be obtained or that all conditions of closing will be met.

Concurrent Financing

In connection with the Transaction, Canadian Gold will complete a concurrent non-brokered private placement of subscription receipts ("Subscription Receipts") at a price of $0.25 per Subscription Receipt, for minimum gross proceeds of at least $1,450,000 up to a maximum of $1,700,000 (i.e., a minimum issuance of 5,800,000 Subscription Receipts up to a maximum issuance of 6,800,000 Subscription Receipts), or such other amounts as the parties agree in order for the Resulting Issuer to meet the Exchange's listing requirements (the "Concurrent Financing"). Each Subscription Receipt shall automatically convert, for no additional consideration, upon the satisfaction of escrow release conditions – including but not limited to the completion of the Transaction - into one post-Consolidation Amseco Share.

Finder's fees may be paid in connection with the Concurrent Financing within the maximum amount permitted by the policies of the Exchange.

The proceeds of the Concurrent Financing will be used to fund (i) expenses of the Transaction and the Concurrent Financing, (ii) the exploration and other expenses relating to the Lac Arsenault property, and (iii) the working capital requirements of the Resulting Issuer.

Summary of Proposed Directors and Officers of the Resulting Issuer

In conjunction with and upon closing of the Transaction, the board of directors of the Resulting Issuer are expected to consist of the following five directors: Ronald (Ron) Goguen, Ken Booth, Mark Smethurst, Roger Bourgault, and Ian McGavney. These directors shall hold office until the first annual meeting of the shareholders of the Resulting Issuer following closing, or until their successors are duly appointed or elected. The first officers of the Resulting Issuer are expected to be Ron Goguen (Executive Chairman and President), Camilla Cormier (Chief Financial Officer and Corporate Secretary), and such other officers as determined by Canadian Gold.

Biographies of the proposed directors and officers of the Resulting Issuer are provided below:

Ron Goguen, Chairman and Chief Executive Officer

Mr. Goguen purchased his first exploration drilling company, Ideal Drilling, in 1980. In 1981, he added a second exploration drilling company. Those companies were combined to become Major Drilling Group International Inc., a publicly traded company that has traded on the TSX-V since March 1995. He served as President and Chief Executive officer until 2000 and during this time was a key driving force in building Major Drilling into one of the largest mineral drilling service companies in the world (33 operations in 15 countries). Since leaving Major Drilling in 2000, Mr. Goguen was chairman and co-founder of Beaver Brook Antimony Mine Inc., which is the largest antimony mine outside China. He was a member of the board of directors of Northeast Bank of 20 years (1990 to 2010). During 1995, he was named Atlantic Canada's Entrepreneur of the year as presented by Government General of Canada.

Camilla Cormier, Chief Financial Officer and Corporate Secretary

Ms. Cormier CA, CPA has over thirty years' experience in accounting and finance including fifteen years in senior financial positions with public companies including Silver Spruce Resources Inc. and prior to then, as the Controller of Sparta Manufacturing Inc.

Ken Booth, Director

Mr. Booth holds a B.Sc. degree in Geology and an MBA. He began his career as a geologist for companies such as Falconbridge, Anaconda and Minnova. Subsequently, Mr. Booth embarked on a career in investment banking and since 1998 has been the chief executive officer of several public companies and is currently a director of two additional public exploration companies.

Mark Smethurst, Director, Technical Manager, and Geologist Consultant

Mr. Smethurst has over 25 years of experience in the mining and exploration industry, with a special focus on vetting and identifying prospect mineral properties and developing mineral resources. He obtained a master of science degree in geophysics from the University of Windsor in 1998 and is a Professional Geoscientist. From 2004-2013, Mr. Smethurst was employed in several roles ranging from Project Geologist to Vice President – Development and Exploration and was responsible for, among other things, authoring technical reports, performing property assessments and acquisitions, locating mineralization, establishing drill programs, and conducting drilling. Since 2014, Mr. Smethurst has been employed as an acquisition and valuation analyst in mining and metal where he has provided opinions, property valuations, reviewing production and growth opportunities of economically viable deposits, and drafting reports on economic mineral valuation assessments. From October 2018 to January 2021, Mark served as an independent director of Tocvan Ventures Corp., a CSE-listed issuer, and also served as its chief operating officer from December 2019 to January 2021.

Roger Bourgault, Director

Mr. Bourgault served as Chairman at Amseco Exploration Ltd. and obtained an undergraduate degree from the University of Québec in 1986.

Ian McGavney, Director

Mr. McGavney is the president and chief executive officer of Colibri Resources Corp. and founder and former president of Skype Capital Corporation and Northern Lorena Resources. He has over 20 years of experience in junior resource business development, company operations, finance, and marketing.

Sponsorship of Transaction

Sponsorship of the Transaction may be required by the Exchange unless an exemption or waiver from this requirement is obtained in accordance with the policies of the Exchange. Canadian Gold has not yet engaged a sponsor in connection with the Transaction. Canadian Gold intends to apply for a waiver from the Exchange's sponsorship requirement. Additional information on sponsorship arrangements will be provided once available.

Other Information relating to the Transaction

The Transaction is not a "related party transaction" as such term is defined by Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions and is not subject to Policy 5.9 of the Exchange.

No finder's fees are expected to be payable in connection with the Transaction.

In accordance with Exchange Policy 5.2, shareholder approval from shareholders of Amseco will not be required, as the Transaction exhibits the following characteristics: (i) the Proposed Transaction is not a related party transaction (and no other circumstances exist which may compromise the independence of Amseco or other interested parties); (ii) Amseco does not have active operations; (iii) Amseco is not subject to a cease trade order and management believes it will not be suspended from trading on completion of the Transaction; and (iv) there is no requirement to obtain shareholder approval of the Transaction (or any element thereof) under any applicable corporate or securities laws.

In accordance with the policies of the Exchange, Trading in the Amseco Shares has been halted as a result of this announcement. and will not resume trading until such time as the Exchange determines, which, depending on the policies of the Exchange, may not occur until completion of the Transaction.

Additional information concerning the Transaction, Amseco, Canadian Gold and the Resulting Issuer will be provided once determined in a subsequent news release and in the Filing Statement to be filed by Amseco in connection with the Transaction and which will be available in due course under Amseco's SEDAR profile at www.sedar.com.

About Amseco Exploration Ltd.

Amseco is a mineral exploration company focused on the acquisition, exploration and development of mineral resource properties.

For further information regarding Amseco and the Proposed Transaction, please contact Jean Desmarais, Chief Executive Officer of Amseco, at jeandesmarais@mac.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF AMSECO EXPLORATION LTD.

Jean Desmarais, Director and CEO

jeandesmarais@mac.com

1-514-898-5326

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Person

Mark T. Smethurst, P.Geo., a director of Canadian Gold. is a qualified person as defined by NI 43-101 and has reviewed and approved the contents and technical disclosures in this press release. Neither Mr. Desmarais nor the Company has verified the technical information in this press release.

Completion of the Transaction is subject to a number of conditions, including but not limited to, Exchange acceptance and if applicable pursuant to Exchange Requirements, disinterested approval. Where applicable, the Transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Amseco should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the Transaction and has neither approved nor disapproved the contents of this press release.

All information contained in this news release with respect to Amseco and Canadian Gold was supplied by the parties, respectively, for inclusion herein, and Amseco and its respective directors and officers have relied on Canadian Gold for any information concerning such party.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. "United States" and "U.S. Person" are as defined in Regulation S under the U.S. Securities Act.

Forward Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations (including negative and grammatical variations) of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking information in this press release may include, without limitation, statements relating to: the completion of the Transaction and the timing thereof, the proposed business of the Resulting Issuer, degree to which historical results are reflective of actual mineral resources, the completion of the proposed Concurrent Financing and the use of proceeds therefrom, the completion a NI 43-101 technical report for the Lac Arsenault property, the proposed directors and officers of the Resulting Issuer, obtaining regulatory approvals for the Transaction, the completion of the Consolidation, the completion of the Name Change, completion of satisfactory due diligence, Exchange sponsorship requirements and intended application for exemption therefrom, shareholder and regulatory approvals, and future press releases and disclosure.

These statements are based upon assumptions that are subject to significant risks and uncertainties, including risks regarding the mining industry, commodity prices, market conditions, general economic factors, management's ability to manage and to operate the business, and explore and develop the projects, of the Resulting Issuer, and the equity markets generally. Because of these risks and uncertainties and as a result of a variety of factors, the actual results, expectations, achievements or performance of each of Amseco and Canadian Gold may differ materially from those anticipated and indicated by these forward-looking statements. Any number of factors could cause actual results to differ materially from these forward-looking statements as well as future results. Although each of Amseco and Canadian Gold believes that the expectations reflected in forward looking statements are reasonable, they can give no assurances that the expectations of any forward-looking statements will prove to be correct. Except as required by law, each of Amseco and Canadian Gold disclaims any intention and assume no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward-looking statements or otherwise.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

SOURCE AMSECO EXPLORATION LTD.

Jean Desmarais, Director and CEO,

jeandesmarais@mac.com, 1-514-898-5326

Share This

Recent News Releases